To mark the 60th anniversary of the Julius Baer Foundation, we are launching the '60 facts on wealth inequality' series. This initiative aims to shed light on the causes and consequences of wealth inequality, exploring its impact on social and economic balance, and its far-reaching consequences on individuals, communities, and society as a whole.

The first edition of our series presents a global perspective on socio-economic disparities, highlighting the complex and pressing issue of wealth inequality at a macro level. Wealth inequality is a multifaceted challenge that arises from a combination of factors, including economic systems, policies, and social structures. As Ariane De Lannoy, Professor at the University of Cape Town and a renowned expert on wealth inequality, notes:

"Wealth inequality isn't just about the amount of money in one's bank account; it's about the ability to build wealth, and that starts very early on in life. When we think about children and people living in poverty, income poverty is not the only aspect of deprivation that affects these individuals; it also influences the types of education they can access, the types of housing they can live in, and the types of health outcomes they experience. All of these factors eventually determine whether or not someone can secure a particular type of job. If that job is a low-income or unstable one, then it perpetuates the cycle of exclusion and inequality."

Understanding Wealth Inequality

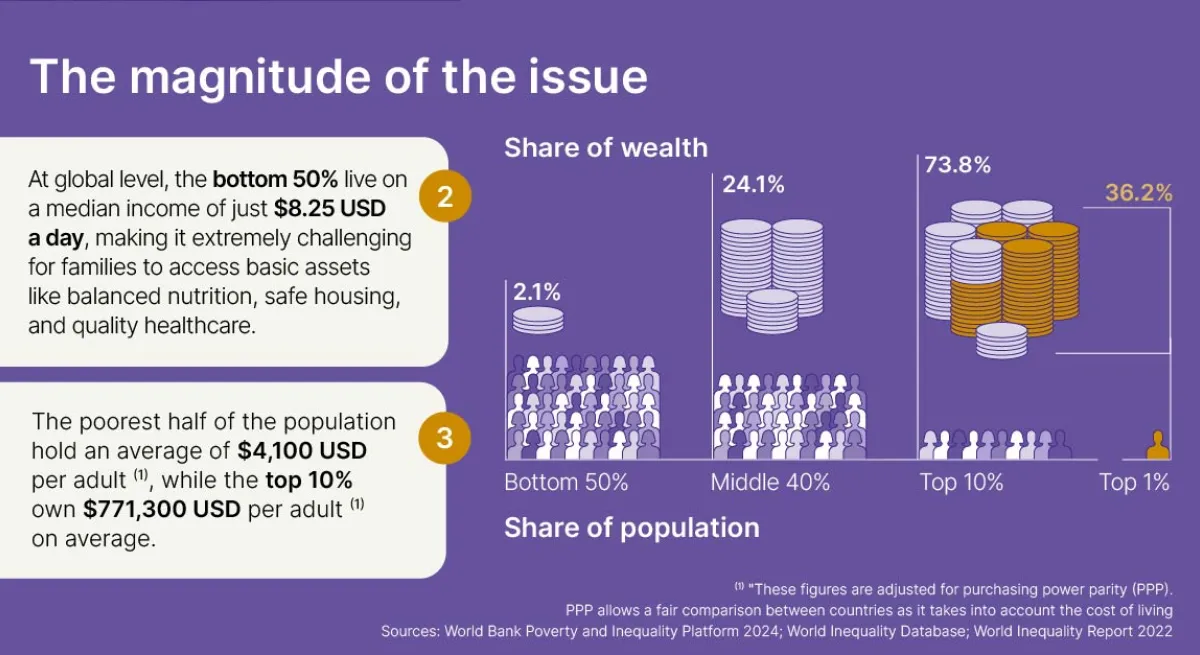

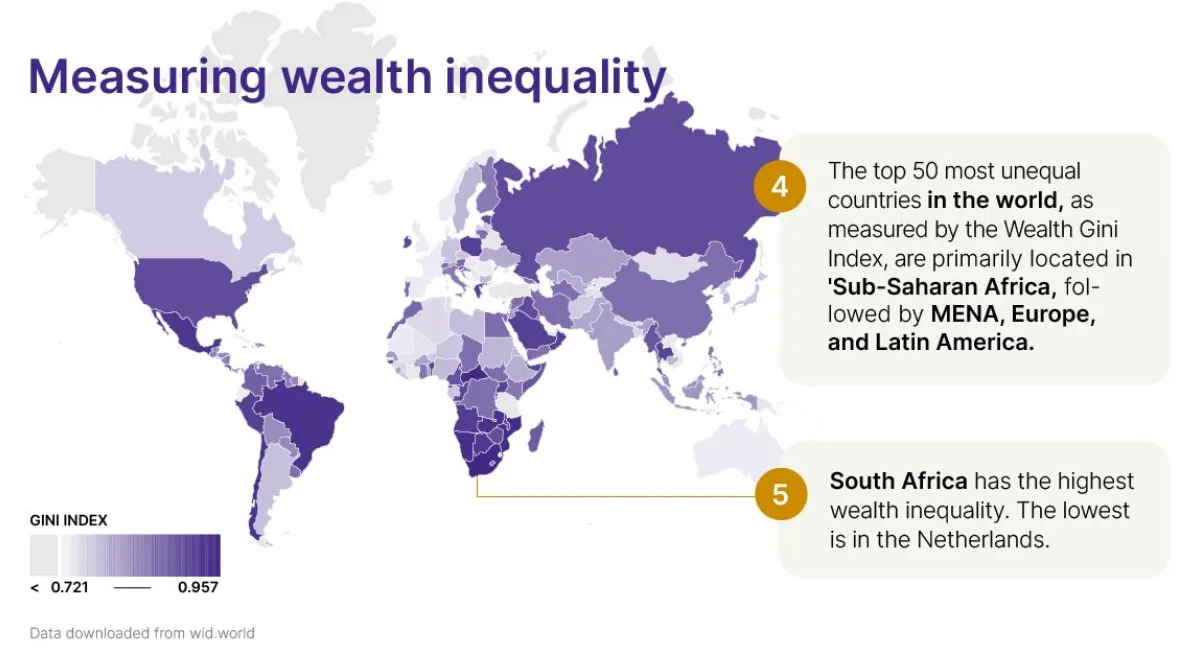

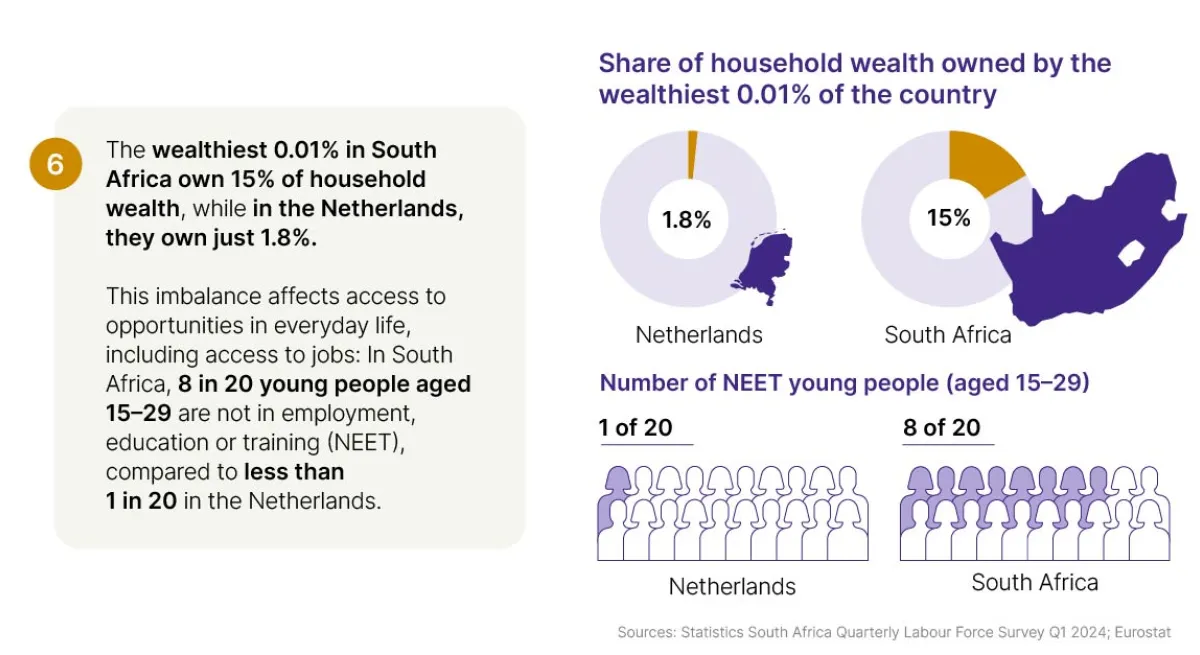

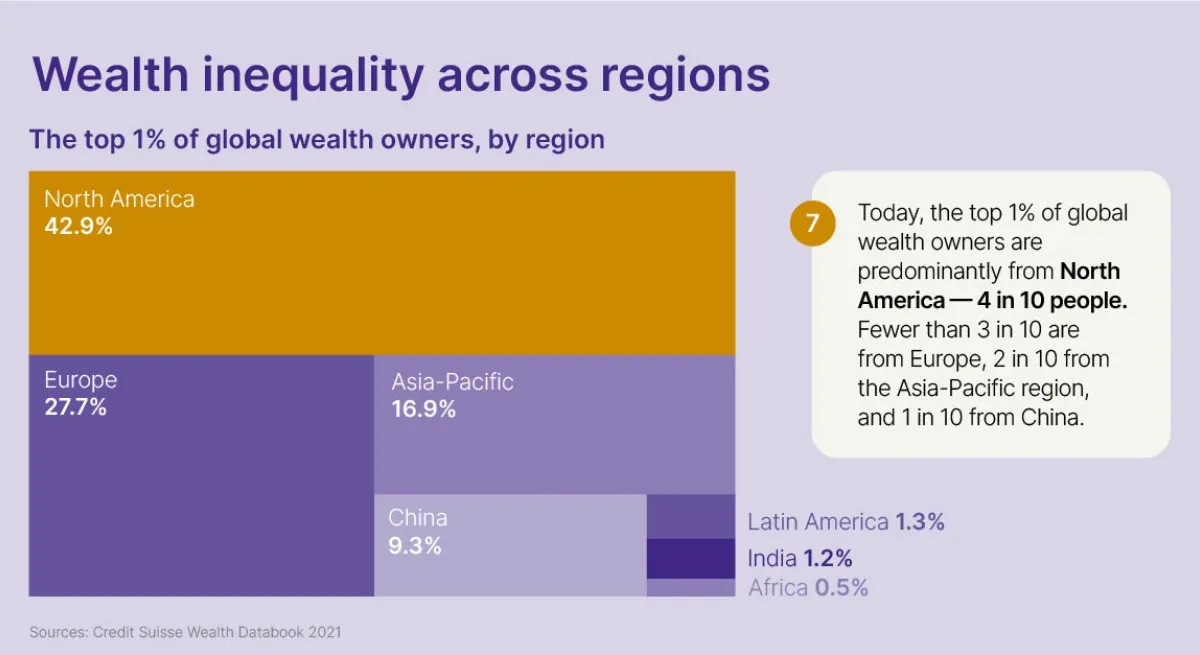

Wealth inequality remains a profound and persistent global issue, with the top 1% holding over one-third of total wealth. While some countries, such as South Africa, Brazil, Russia, and the United States, struggle with extreme levels of wealth inequality, others, like the Netherlands, have made notable progress in reducing wealth disparities, demonstrating that a more equal distribution of wealth is possible.

Additionally, the way people hold their wealth varies greatly from one region to another, reflecting underlying differences in economic systems and societal structures. For instance, in North America, a large proportion of wealth is held in financial assets, whereas in India, more than two-thirds of wealth is non-financial, largely comprising land ownership.

Far-reaching Consequences

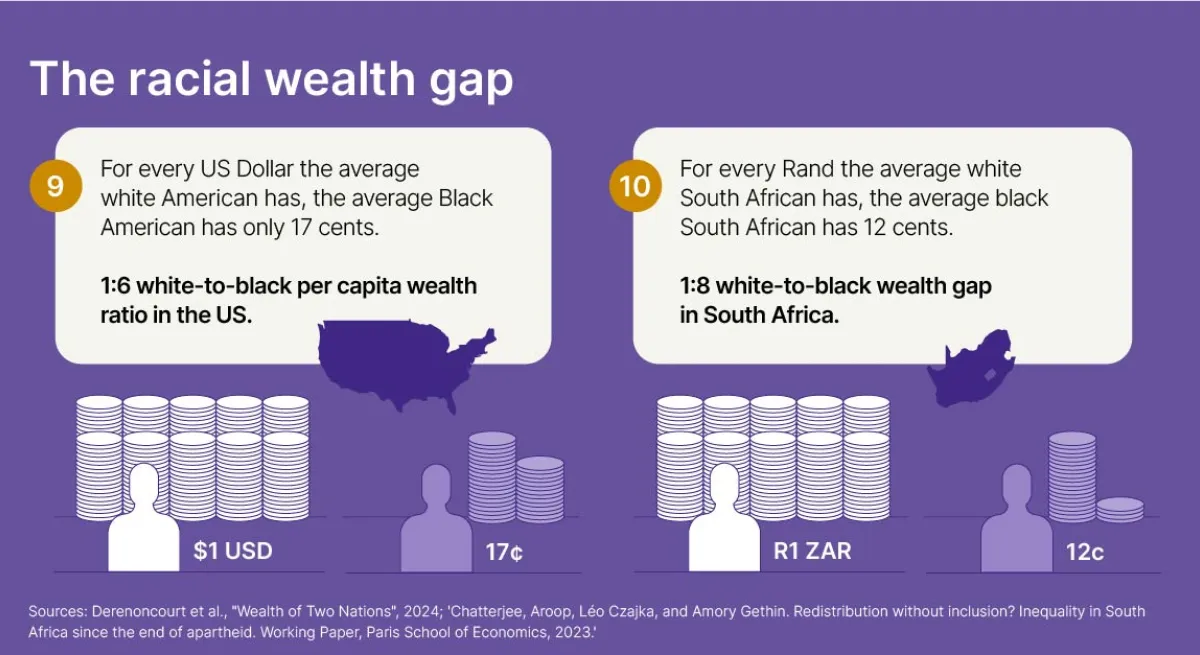

The far-reaching consequences of wealth inequality affect individuals and communities in numerous ways. The racial wealth gap, for example, is a significant concern, with the average white American holding 17 times more wealth than the average Black American, and in South Africa, the average white citizen holding eight times more wealth than their black counterpart.

The effects of wealth inequality extend far beyond financial disparities, influencing access to essential resources, such as education, healthcare, and job opportunities. This, in turn, can have a lasting impact on the prospects of individuals, particularly young people, and ultimately perpetuate cycles of inequality. Certain countries exemplify these challenges, where large numbers of young people are excluded from opportunities for education, employment, and personal growth, underscoring the need for urgent attention and action to address the root causes of wealth inequality and work towards more equal opportunities.

Taking Action

Addressing wealth inequality is a complex issue that requires systemic change and time. However, it is clear that initiatives aimed at promoting greater equality must adopt a holistic approach, bridging the gap between wealth, access to opportunities, and social capital development. We believe that by bringing together socio-economic groups from both ends of the wealth spectrum, they can learn from each other and foster productive partnerships that go beyond charitable donations. Our goal is to address both the economic and social dimensions of the challenge, and we invite you to join us in this endeavour.

PDF 60 facts on wealth inequality: global view

To explore the first 10 facts, offering a global view on the scale and impact of today's socio-economic disparities, please download the PDF here: